Reversal Signal Bars

Indicator for NinjaTrader® 7/8

Features

- shows the following Signal Bars or Patterns

- – Inside Bar

– Reversal Bar (also called Pin Bar)

– Inside Inside Pattern

– Inside/Outside/Inside Pattern

– Outside/Inside/Outside Pattern

– Two Bar Reversal

– Three Bar Reversal

– Outside/Outside Pattern

– Outside Bar

– Final Flag (impending reversal)

– Inside Bar Breakout Pullback

– Two Bar Breakout Pullback - “Barb Wire” (a special kind of a tight trading range)

- show entry and possible locations for a stop loss

- configure minimum Signal Bar/Pattern size and minimum Overshoot of prior bars

- configure bar size for 1st bar of session on a gap up/dn (for RTH traders, a large 1st bar of the day is often a trading range)

- use as a discretionary indicator and for Automated Trading with BloodHound

- alert feature

- does not work on HeikenAshi, Kagi, Renko, PointAndFigure and LineBreak charts

Example Charts

All of our available paid indicators are distributed in one package.

This package also includes a chart template (“PA_Indicators_ES_5min”) .

After installing the indicator package into NinjaTrader, that chart template can be

used to show a possible setup of the indicators for the ES E-mini 5 minute RTH chart.

Download For NinjaTrader 7

Download For NinjaTrader 8

FAQ

Automated Trading

Only the NinjaTrader 8 version of the Reversal Signal Bars indicator is compatible with BloodHound from SharkIndicators or can be used in the Market Analyzer/Strategy Builder of NinjaTrader. You can call it as well from your own NinjaTrader indicators or strategies.

Can I simply trade every Reversal Signal?

This largely depends on context, trading style and stop loss (e.g. using a wider stop, than a bar stop), also on your ability to scale in. Please check out this separate post about Reversals. Also check out the Blog for more examples on how to use Reversal Signal Bars in your trading.

Confluence is very important in trading and means to have several (at least two) reasons to take a trade. Your 1st reason is the reversal signal bar/pattern and your 2nd reason can be e.g. support at HOY/LOY/COY, measured moves, trend line / trend channel line overshoot, Buying/Selling Pressure, Tick Failure Breakouts, Breakout Tests, a 2nd attempt to reverse and many more.

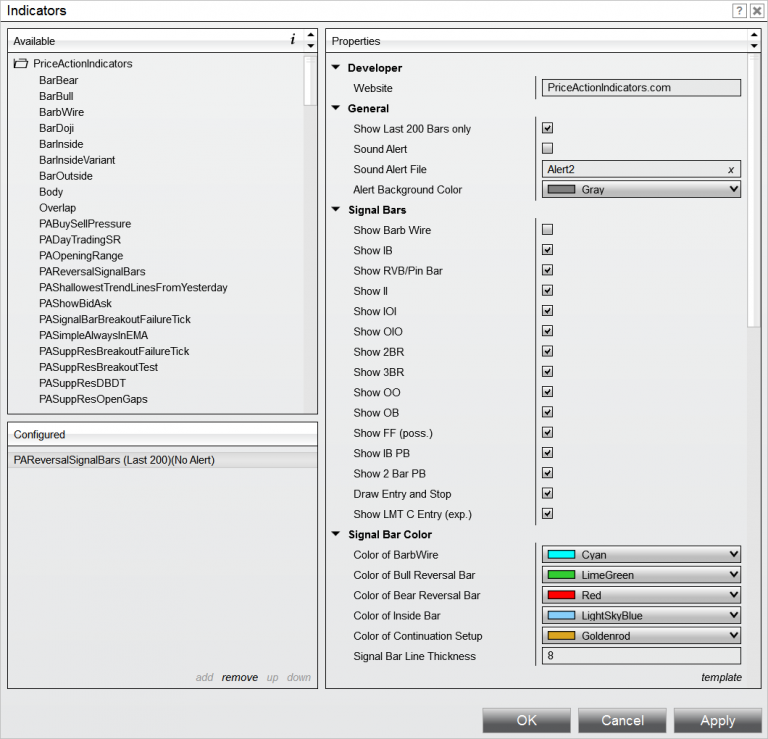

What are the Settings?

The default settings are “optimized” for the ES E-mini 5 min RTH chart and probably need to be tweaked especially to the “personality” and time frame of the instrument you’re trading.

If you trade the MES, load the indicator on the ES chart (the volume is much larger) and take the trades on the MES with the price from the ES contract. Sometimes the MES overshoots though.

Indicator name: PAReversalSignalBars

Show Last 200 Bars only

Show the indicator signals only for the last 200 bars, which will speed up a reload of the chart or indicator. Switch off for back testing.

Sound Alert

Play a sound and show an alert in the alert window

Sound Alert File

Pick a .WAV file from the NinjaTrader sound folder

Signal Bar

Enable or disable to show the different Reversal Signal Bars or Patterns

Draw Entry and Stop

The stop entry price and possible stop loss prices are drawn on the chart.

Show LMT C

Show a possible limit close buy/sell for a Signal Bar (instead of a stop entry above/below the Signal Bar). The features of the Signal Bar and relation to prior bars determine, if this shows up for a specific bar.

That is an experimental feature.

Signal Bar Color

Signal Bar Color and the thickness of the line to highlight them on the chart

IB PB and 2 Bar PB are the continuation setups

Signal Bar Text

Enable or disable the display of text, text color, size and offset from Signal Bar high or low

Plots

The plots can be used in the NinjaTrader Market Analyzer.

Buy Sell Pressure Indicator for NinjaTrader® 7/8

Reversal Signal Bars Indicator for NinjaTrader® 7/8

Support and Resistance – Breakout Failure Indicator for NinjaTrader® 7/8

Support and Resistance – Breakout Test Indicator for NinjaTrader® 7/8

Support and Resistance – Double Bottom / Double Top Indicator for NinjaTrader® 8 ONLY!

Get Access To Free Mt4 Indicators & Much More

Phone

+91-9958406102

Skype

intraday.trading

StockRadar.in

Telegram

Stockxperts

Inquiries

For any inquiries please email

+91-9958406102

- . Experienced .

- Specialized .

- Professional .