ROBOT TRADING

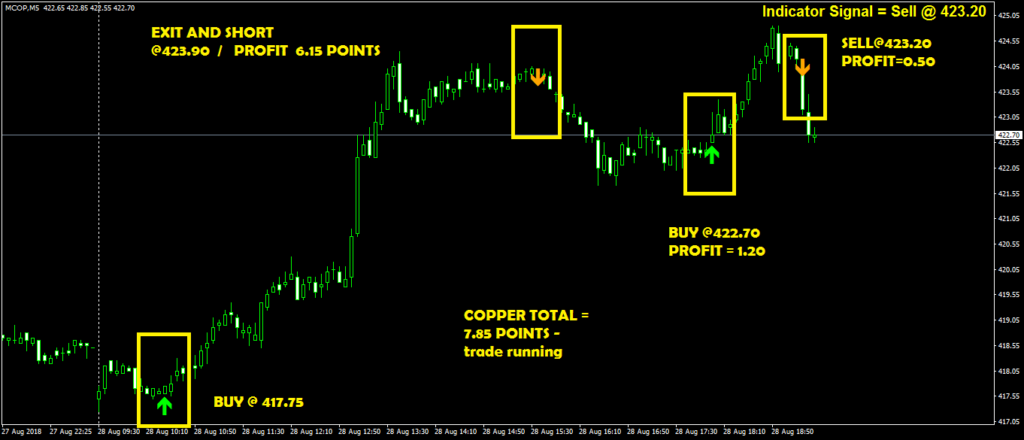

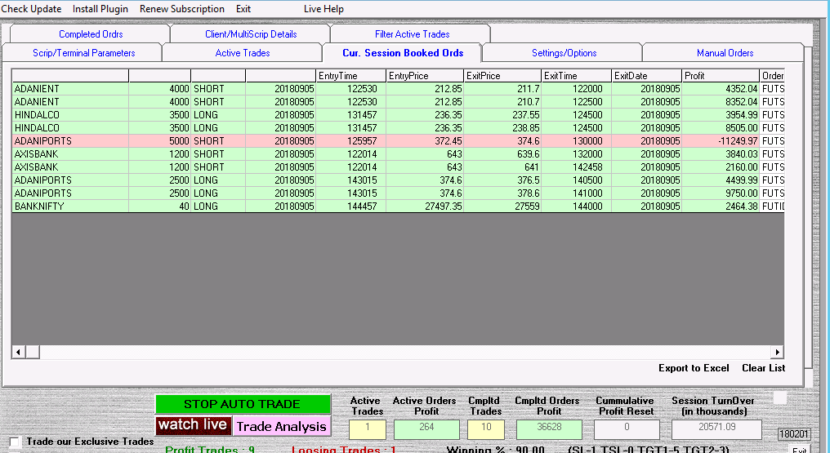

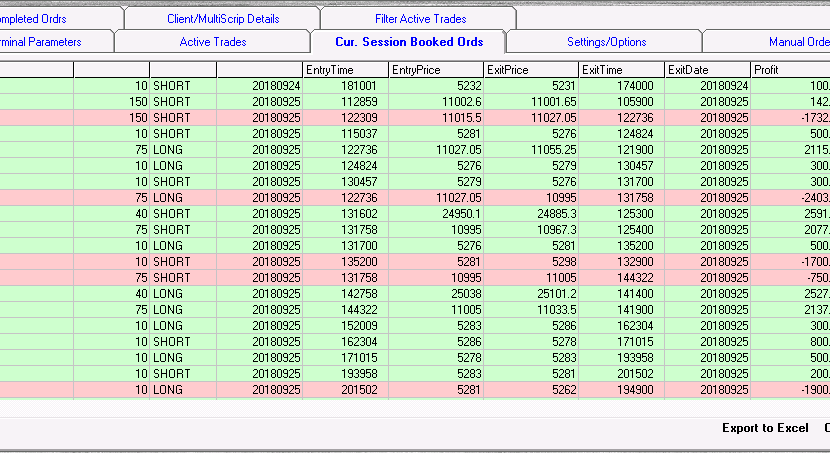

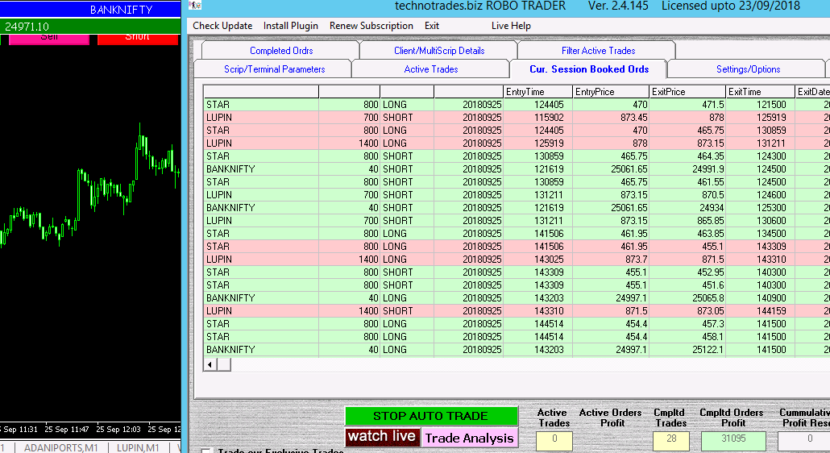

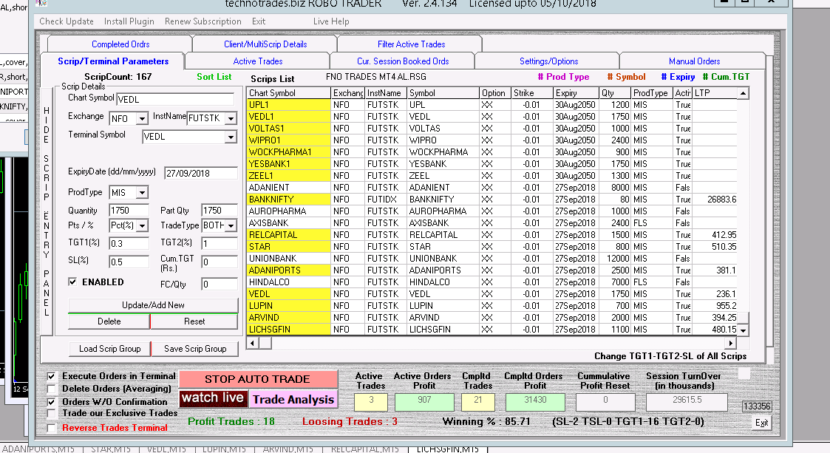

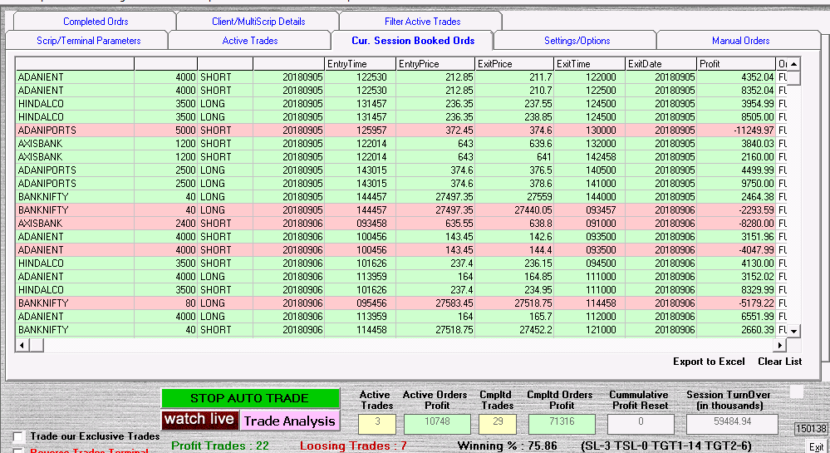

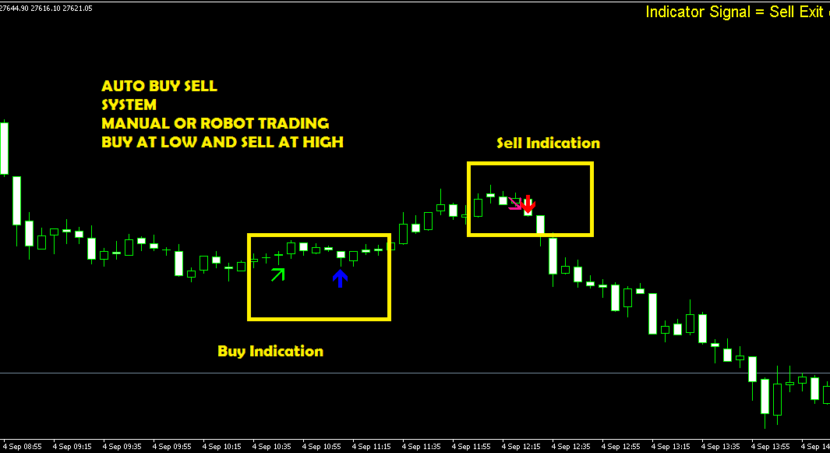

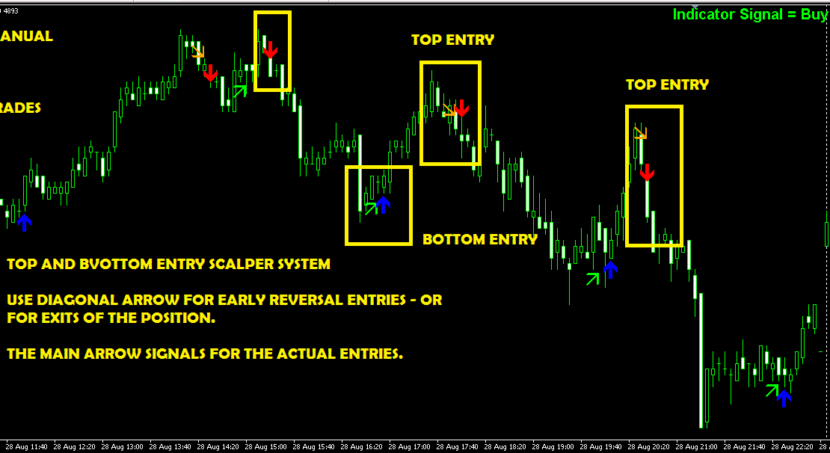

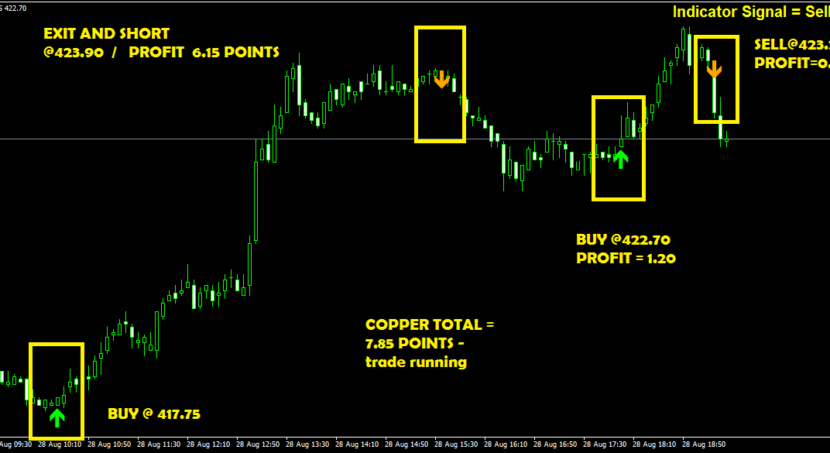

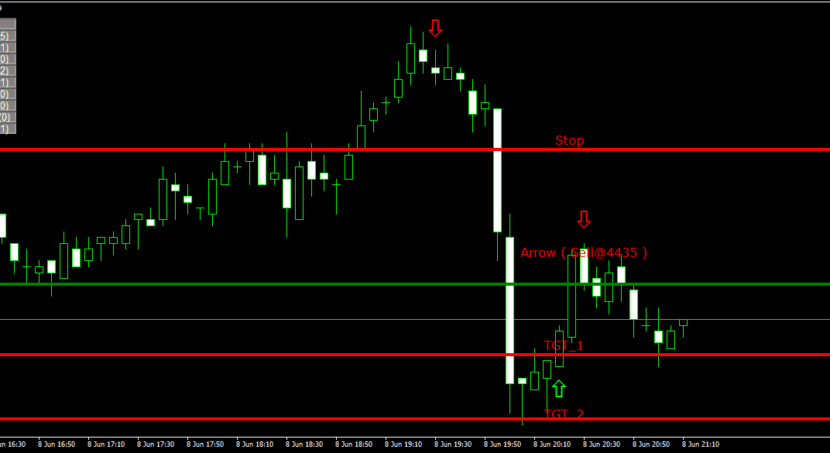

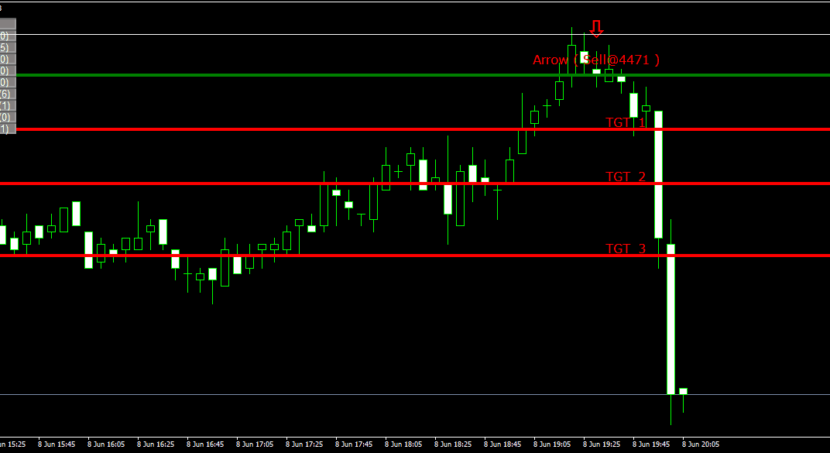

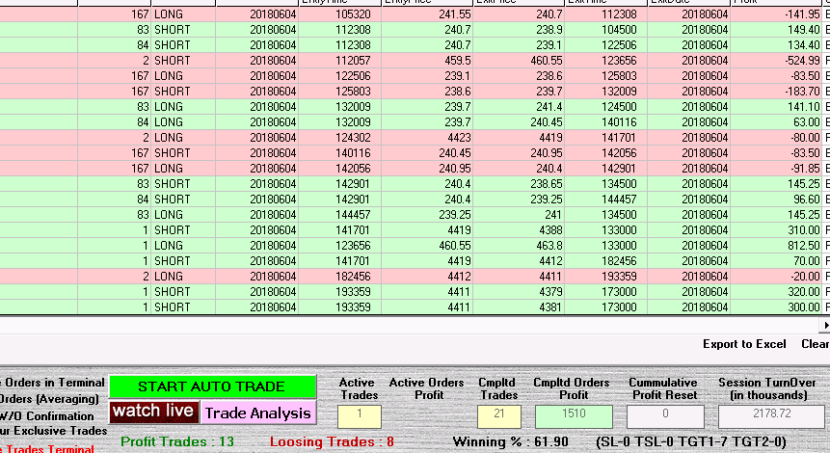

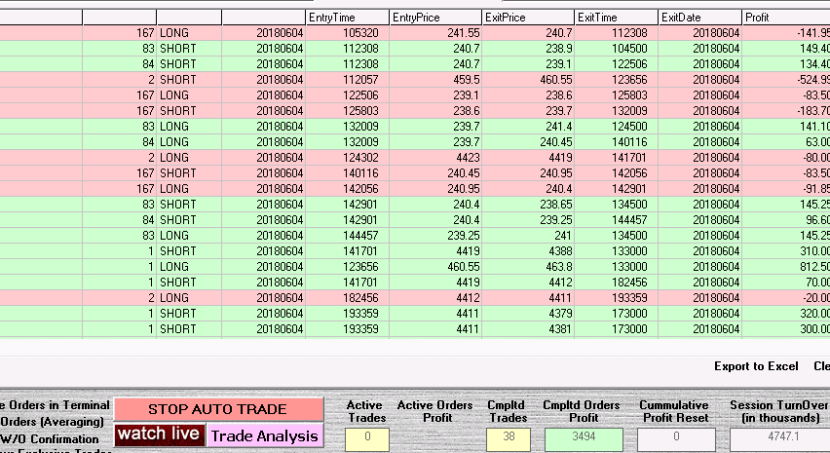

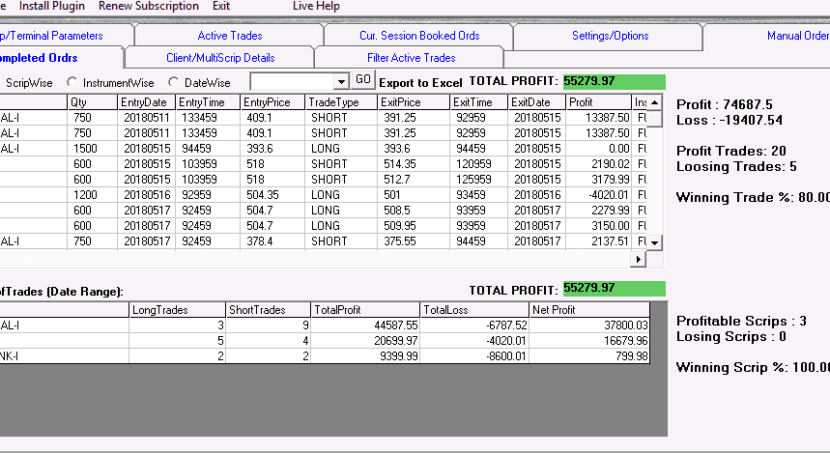

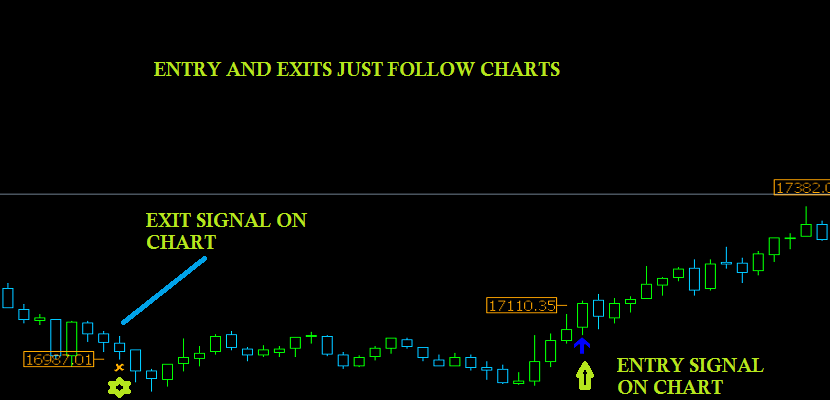

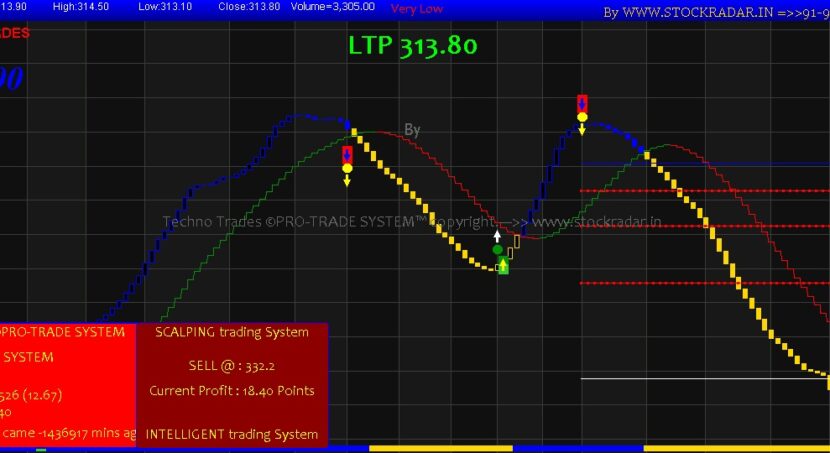

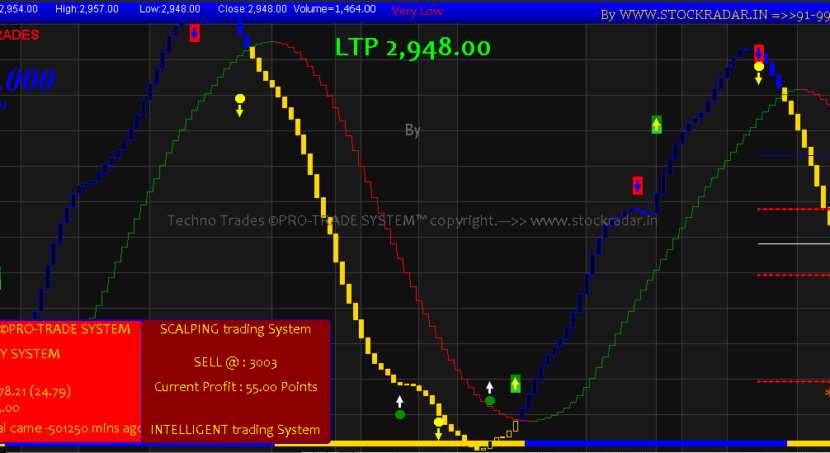

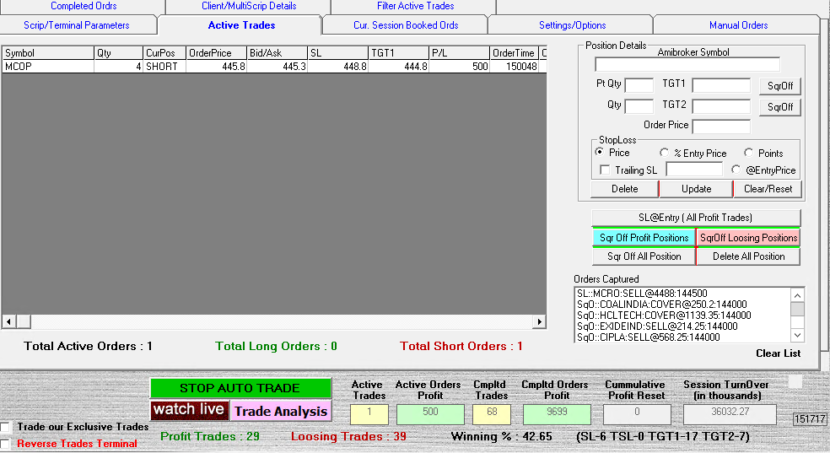

The Robo will take Automatic Buy and Sell Entries along with the best suited Exits at the market Tops and Bottoms. This is highly efficient way of closing the trades in profits .The Human mind is incapable of judging the proper entries and exits like this

The Robo will take Automatic Buy and Sell Entries along with the best suited Exits at the market Tops and Bottoms. This is highly efficient way of closing the trades in profits .The Human mind is incapable of judging the proper entries and exits like this .

Trading is not hard if proper tools and software are used efficiently. Traders especially who enter in trading recently have to take care of a lot of aspects that directly influence their dealing. In order to make right decision at right time, traders have to use certain famous and useful trading software such as, robot trading software for Indian market. Indian traders must use robot trading software for Indian market to analyze current trading market variations. Robot trading software for Indian market is one that keeps traders aware of best moments to make a quick deal either to buy or sell. This is really handy to use and brings several benefits in trading if being used professionally.

ROBOT TRADING

The Robo will take Automatic Buy and Sell Entries along with the best suited Exits at the market Tops and Bottoms. This is highly efficient way of closing the trades in profits .The Human mind is incapable of judging the proper entries and exits like this .

This article discusses issues related to the use of automated trading systems (MTS, also a trading robot) in stock markets.

A generalized characteristic is given for the types of software (software) used for trading. The authors also consider the role of such software in the economy. The study of this article will explain many situations related to the use of trading robots.

Trading robots in the stock markets, which were not a rare phenomenon at the end of the last century, have become so familiar in the present tense that it is difficult to imagine both stock markets and other economic spheres without them.

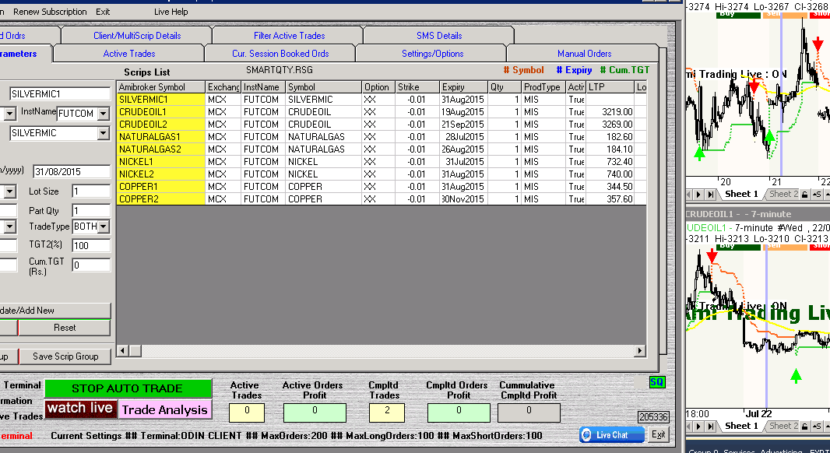

A trading robot is a computer program that is able to independently track data on several indexes on stock exchanges and on their basis to make purchase or sale transactions.

Examples of software. All trading robots (tr) are unique because their development depends on both the personal wishes of the client and the developer’s personality.

But despite this, all TRs can be divided into 2 large groups:

Program advisers. This is a special software that analyzes the market according to one or another popular strategy and gives the trader a signal for It is able to independently track data on several indexes on stock exchanges and on their basis to execute purchase or sale transactions.

This is a special software that analyzes the market according to one or another popular strategy and gives the trader a signal for 2deal.

These programs are the most in demand because they are easy to use and give a quick result.

The main advantage is that the robot, analyzing a large amount of information in a short period of time, leaves the choice of independent decision-making for the person.

The names of the popular software: Metatrader, Equilibrium, Silent Ilan.

Highly technological integrated programs with full risk management.

This software, in which the embedded algorithms of transactions allow based on the analysis of market data to automatically make market transactions, without the direct involvement of the trader.

For example, robots with a scalping strategy (robots-scalpers) are aimed at obtaining a large profit in a relatively short time (high-frequency trading (hft)).

So they can make about 1000% per annum. Respectively, With the increase in profitability, the risk also increases.

The names of the popular software: QuikFan, SuperADX, Autopilot, Bunny (NYSE).

Theory 1

Robots speculate in prices and cause economic crises. Speculation is the receipt of high income due to high risk, including scalping. Often trading robots buy “speculators”.

The trading robot acts according to the algorithms embedded in it. Following the strategy of speculation, the robot will buy cheaper and sell more expensive, or vice versa.

An example of a negative economic wobble can serve as a Flash-crash. So called the collapse of the US stock market on May 6, 2010. Then for a few minutes, the Dow Jones index unexpectedly for most traders fell by 1000 points (9%), but then immediately regained its position.

The reason is only known that at the beginning, the mutual fund began to sell a large number of contracts E-Mini S

Theory 2

The number of robots will increase. Since the main purpose of trading robots is high-frequency trading. Such trading makes non competitive players not using robots.

Thus, they will displace their “slow” competitors. Table 1 The share of high-frequency trading in the total trading volume of exchanges NYSE, LSE and MICEX New York Stock Exchange London Stock exchange Year (NYSE) (LSE)% 11%% 13%% 14%% 29% 38% Moscow Exchange (MICEX)% 35% 20%%%% As can be seen from the table, the average share of trades using HFT trade on the LSE and NYSE stock exchanges for 2010 is approximately equal to 45%.

On the other European trading floors, the situation is not much different to this day. The resulted statistics allows to draw a conclusion that trading robots for today form a significant part of a trading turn on world exchange platforms, while at the same time having an important impact on the entire exchange infrastructure.

The conclusion

A trading robot is a complex, but also an effective tool. TR performs all the routine work for a trader, you can even say that it’s “the hands of a trader.”

But a trader is obliged to manage such equipment skillfully, otherwise it will be “out of the market” with a high probability.

In the hands of an experienced trader, the trading robot is the best tool for implementing the trading strategy chosen by this trader. otherwise it will be “out of the market” with a high probability.

Conclusions.

Benefits. Among all the advantages of trading robots, the following are the most important factors:

- Speed. A trading robot can perform many operations almost simultaneously: track quotations of securities, instantly produce complex calculations, make decisions, instantly make transactions. With the use of modern technologies, the best equipment, the speed of operations can be measured in milliseconds.

- Accuracy. The robot does not err when analyzing data and submitting applications, and, unlike the trader, will never mistake the operation of the purchase and the sale operation, it will not be mistaken with the price and quantity when entering the application.

- Lack of fatigue. A trading robot can work 24 hours a day. A person is physically unable to spend such a time completely in front of the monitor due to its natural component. This also allows you to reduce the time to implement the trading strategy and eliminates the debilitating labor. It should be noted that the robot requires systematic monitoring and optimization for efficient operation.

- Lack of emotion. The non-emotional component of the trading robot allows you to implement the trading strategy of the trader without delay. TP will follow the algorithm, which is embedded in it, excluding human emotions, pushing players into mistakes. Disadvantages. But in addition to the significant advantages, trade robots are not without shortcomings: 1. In financial costs, a purchase or creation of a trading robot should be provided. As a rule, ready-made software implements simple algorithms and costs relatively cheaply (rubles). Individual development of TR is the writing of the trader’s own trading algorithms and costs significantly more (more than rubles). 2. Risk of computer failures. In the case of a software error, the trading robot may continue to operate incorrectly, making unprofitable transactions.

- This also includes the risk of breaking the connection to the Internet, power outage, etc. 3. Lack of response to non-standard situations. Typically, the robot is focused on working in any specific market conditions. Unexpected sharp reversals of the trend, increased volatility of the market in price movements can lead to a “disorientation” of TR, and as a consequence to commit a loss-making transaction. 4. Not emotional.

However, this is both an advantage and a disadvantage. For example, a robot, accurately adhering to the algorithm embedded in it, without a doubt, can spend all the capital in one trading session.

Get Access To Free Mt4 Indicators & Much More

Phone

+91-9958406102

Skype

intraday.trading

StockRadar.in

Telegram

Stockxperts

Different Type of Strategies

1

Intraday Trading

2

Forex Trading

3

Scalping

4

Robot Trading (Manual/ Auto Trading)

Inquiries

For any inquiries please email

+91-9958406102

- . Experienced .

- Specialized .

- Professional .