Buy Sell Pressure

Indicator for NinjaTrader® 7/8

Features

- Shows Strength of a Trend, by examining bar features and relation to prior bars (bodies, tails, overlap and open/close)

- identifies possible Momentum and Exhaustion by showing

– Buying Pressure in a bull move and Selling Pressure in a bear move (momentum)

– Selling Pressure in a bull move and Buying Pressure in a bear move (exhaustion) - use as a discretionary indicator and for Automated Trading with BloodHound

- alert feature

- does not work on HeikenAshi, Kagi, Renko, PointAndFigure and LineBreak charts

Example Trade Video

https://www.youtube.com/watch?v=J8JpWGMpNkY&feature=emb_logo

All of our available paid indicators are distributed in one package.

This package also includes a chart template (“PA_Indicators_ES_5min”) .

After installing the indicator package into NinjaTrader, that chart template can be

used to show a possible setup of the indicators for the ES E-mini 5 minute RTH chart.

Download For NinjaTrader 7

Download For NinjaTrader 8

FAQ

Can I simply buy or sell the close of every momentum bar or signal?

- This largely depends on context, trading style and stop loss (risk), also on your ability to scale in and the use of wide or swing stops (below the last higher low or above the last lower high in a trend).

- for higher probability, wait for a pullback and enter on a with trend bar (e.g. with a bar stop) and an initial risk/reward of at least 1 (IR/R=1)

- advanced traders can buy below the prior bar (in a bull) or sell above the prior bar (in a bear), if that is a with trend bar

- the ability to scale in and use a swing stop greatly increases the probability of a successful trade

- also look for confluence of multiple Buying Pressure / Selling Pressure signals and with other indicators or Support / Resistance

Can I simply buy or sell the close of every exhaustion bar or signal?

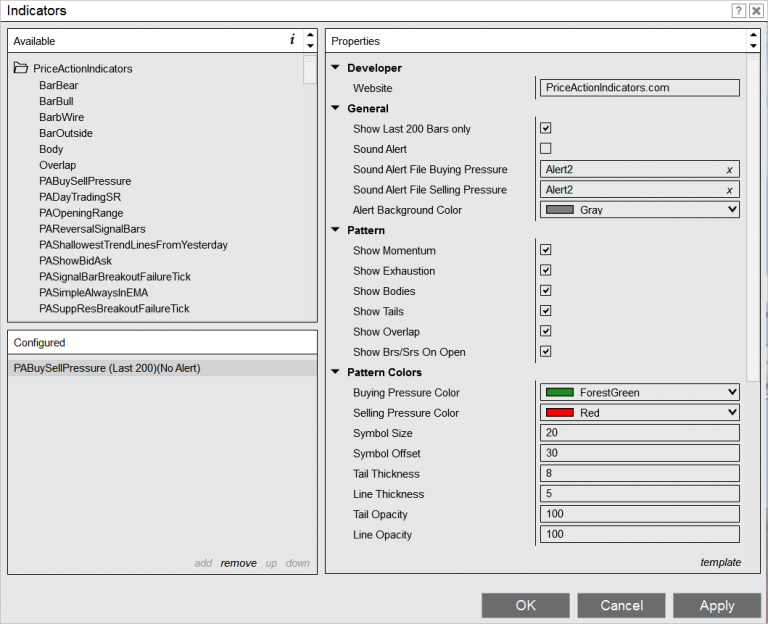

What are the settings?

- This largely depends on context, trading style and stop loss (risk), also on your ability to scale in and the use of wide or swing stops (below the last higher low or above the last lower high in a trend)

- to increase the probability of a successful counter trend trade you can wait for a strong Reversal Signal Bar after a couple of pushes at support or resistance and trade the breakout of that with a stop entry

- in a pullback in a trend it’s reasonable to buy/sell closes to enter with trend

- advanced traders can buy below or sell above (and scale in) swings created by exhaustion

- also look for confluence of multiple Buying Pressure / Selling Pressure signals and with other indicators or support/resistance

What are the settings?

Indicator name: PABuySellPressure

Show Last 200 Bars only

Show the indicator signals only for the last 200 bars, which will speed up a reload of the chart or indicator

Sound Alert

Play a sound and show an alert in the alert window

Sound Alert File Buying Pressure

Pick a .WAV file from the NinjaTrader sound folder

Sound Alert File Selling Pressure

Pick a .WAV file from the NinjaTrader sound folder

Momentum

Shows Buying Pressure (BGP) in a bull move and Selling Pressure (SGP) in a bear move

Exhaustion

Shows Selling Pressure (SGP) in a bull move and Buying Pressure (BGP) in a bear move

Bodies

Checks the change of bodies of bars for BGP and SGP

Tails

Checks the change of tails of bars for BGP and SGP

Overlap

Checks the change of overlap of bars for BGP and SGP

Buyers/Sellers on Open

Checks for gaps between the Opens of bars and the closes of prior bars

Buy Sell Pressure Indicator for NinjaTrader® 7/8

Reversal Signal Bars Indicator for NinjaTrader® 7/8

Support and Resistance – Breakout Failure Indicator for NinjaTrader® 7/8

Support and Resistance – Breakout Test Indicator for NinjaTrader® 7/8

Support and Resistance – Double Bottom / Double Top Indicator for NinjaTrader® 8 ONLY!

Get Access To Free Mt4 Indicators & Much More

Phone

+91-9958406102

Skype

intraday.trading

StockRadar.in

Telegram

Stockxperts

Working Steps We Follow

1

Research

2

DEVELOP

3

TEST PHASE

4

LAUNCH

Inquiries

For any inquiries please email

+91-9958406102

- . Experienced .

- Specialized .

- Professional .