[ad_1]

Gold costs rebounded, benefiting from the US greenback’s retreat from latest document highs and Treasury yields barely lowered forward of the Fed’s financial coverage announcement.

Stable inventory markets and expectations of aggressive rate of interest hikes restricted gold’s rally. The gold value recovered from the assist degree of $ 1805 an oz. after sharp promoting because the begin of this essential week’s buying and selling. It then reached the extent of $ 1842 an oz., after the rate of interest announcement from the US Federal Reserve. It settled across the degree of $ 1835 an oz., earlier than the Financial institution of England and the Swiss Central Financial institution introduced an replace their financial coverage.

Stronger than anticipated, the US Federal Reserve moved to lift rates of interest by 0.75 factors, and expectations indicated an increase of solely half a degree. The US Federal Reserve has thus ramped up its marketing campaign to tame excessive inflation by elevating its key rate of interest by three-quarters of a degree, its greatest hike in almost three a long time and signaling extra important price will increase to come back that might increase the danger of One other recession. The transfer, introduced by the Fed after its final coverage assembly, will increase the benchmark short-term rate of interest, which impacts many shopper and enterprise loans, to a spread of 1.5% to 1.75%. With the extra price hikes they count on, policymakers count on the important thing price to achieve a spread of three.25% to three.5% by the top of the yr, the very best degree since 2008, that means most types of borrowing will turn into sharply dearer.

The US central financial institution is ramping up its marketing campaign to tighten credit score and sluggish development as inflation hit a four-decade excessive of 8.6%, unfold to extra areas of the economic system and confirmed no signal of slowing. Individuals are additionally starting to count on excessive inflation to proceed for for much longer than it was. This sentiment might embed inflationary psychology within the economic system making it tough to carry inflation again to the Fed’s 2% goal.

The Fed’s three-quarter point rate increase exceeds the half-point improve that Governor Jerome Powell had beforehand advised as more likely to be introduced this week. The Fed’s resolution to pressure a big price hike yesterday was an acknowledgment that it’s struggling to curb and maintain inflation, which has been exacerbated by Russia’s battle towards Ukraine and its affect on power costs.

However, the European Central Financial institution has proposed creating a brand new device to deal with retail dangers throughout the one European foreign money bloc with a view to alleviate fears of the debt disaster. The European Central Financial institution introduced the transfer after an unscheduled financial coverage assembly within the wake of rising bond yields within the area.

The Financial institution of England, which is because of announce its coverage on Thursday, is extensively anticipated to announce one other price hike – the fifth in a row – to fight excessive inflation.

On the US financial entrance, a report from the Commerce Division confirmed that US retail gross sales fell 0.3% in Could after rising by a downwardly revised 0.7% in April. Economists had anticipated retail gross sales to rise 0.2% in comparison with a 0.9% improve initially recorded from the earlier month.

A separate report from the Labor Division confirmed that US import costs rose 0.6% in Could after rising by a revised 0.4% in April. Economists had anticipated import costs to leap 1.1% from the unique studying, which was unchanged from the earlier month. In the meantime, the report confirmed export costs rose 2.8% in Could after a 0.8% improve in April. Export costs had been anticipated to rise by 1.3%.

The New York Fed additionally launched a report displaying that regional manufacturing exercise was little modified in June.

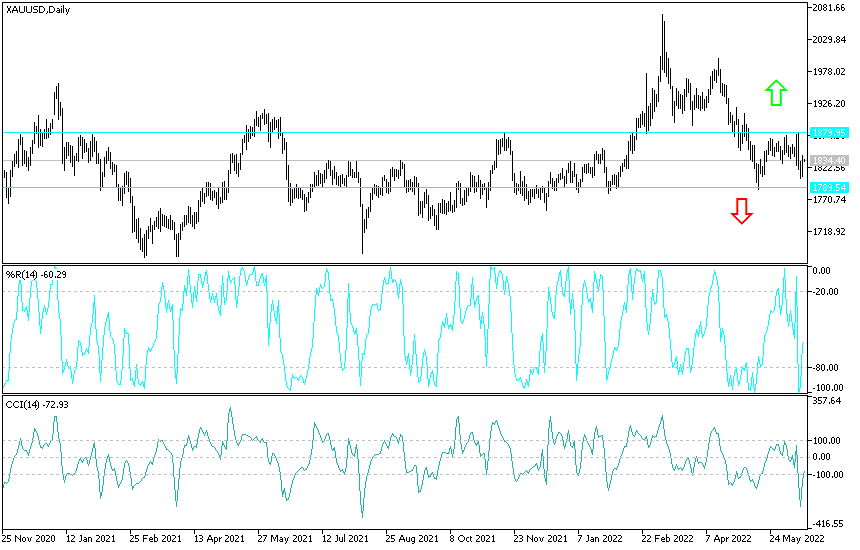

In keeping with the technical evaluation of gold: On the every day chart, the success of the bulls in pushing the worth of gold to the neighborhood of the resistance 1865 {dollars} for an oz., the gold market will return to the impartial zone with an upward bias. Returning to our technical analyses concerning the way forward for the gold value, we have now identified so much on the significance of shopping for gold from each descending degree. The transfer by world central banks to lift rates of interest strongly is offset by different elements supporting gold, foremost of that are world geopolitical tensions and the struggling of the second largest economic system on the planet from a brand new outbreak of the pandemic.

Gold value’s transfer above the resistance of $1865 an oz. will give the bulls the impetus to maneuver additional up, after which an important resistance ranges will probably be 1877 and 1885 {dollars}, respectively. Extra threat urge for food for traders and the restoration of the greenback might negatively have an effect on the worth of gold, however to this point, I nonetheless favor shopping for gold from each bearish degree.

[ad_2]

Source link