[ad_1]

The market ended yet one more risky session on a destructive be aware on June 15, dragged by expertise, FMCG, energy shares and index heavyweight Reliance Industries. The losses had been, nonetheless, capped by Bajaj Finance twins, auto, banking & monetary providers and metallic shares.

At shut, the Sensex was down 152.18 factors, or 0.29 %, at 52,541.39, and the Nifty was down 39.90 factors, or 0.25 %, at 15,692.20. The broader house outperformed frontliners. The Nifty midcap 100 and smallcap 100 indices gained 0.35 % and 0.6 %.

India VIX remained above the essential 20 mark at 22.15, indicating the pattern nonetheless favours bears.

Shares that had been in motion included Strides Pharma Science and Indraprastha Gas, which had been amongst high gainers within the futures & choices section, rising 5 % to Rs 326 and 4 % to Rs 355.35, respectively. Affle India jumped 5.2 % to Rs 1,019.7.

The three shares additionally fashioned a bullish candlestick on the each day charts.

This is what Jigar S Patel of Anand Rathi Shares & Inventory Brokers recommends traders do with these shares when the market resumes buying and selling right this moment:

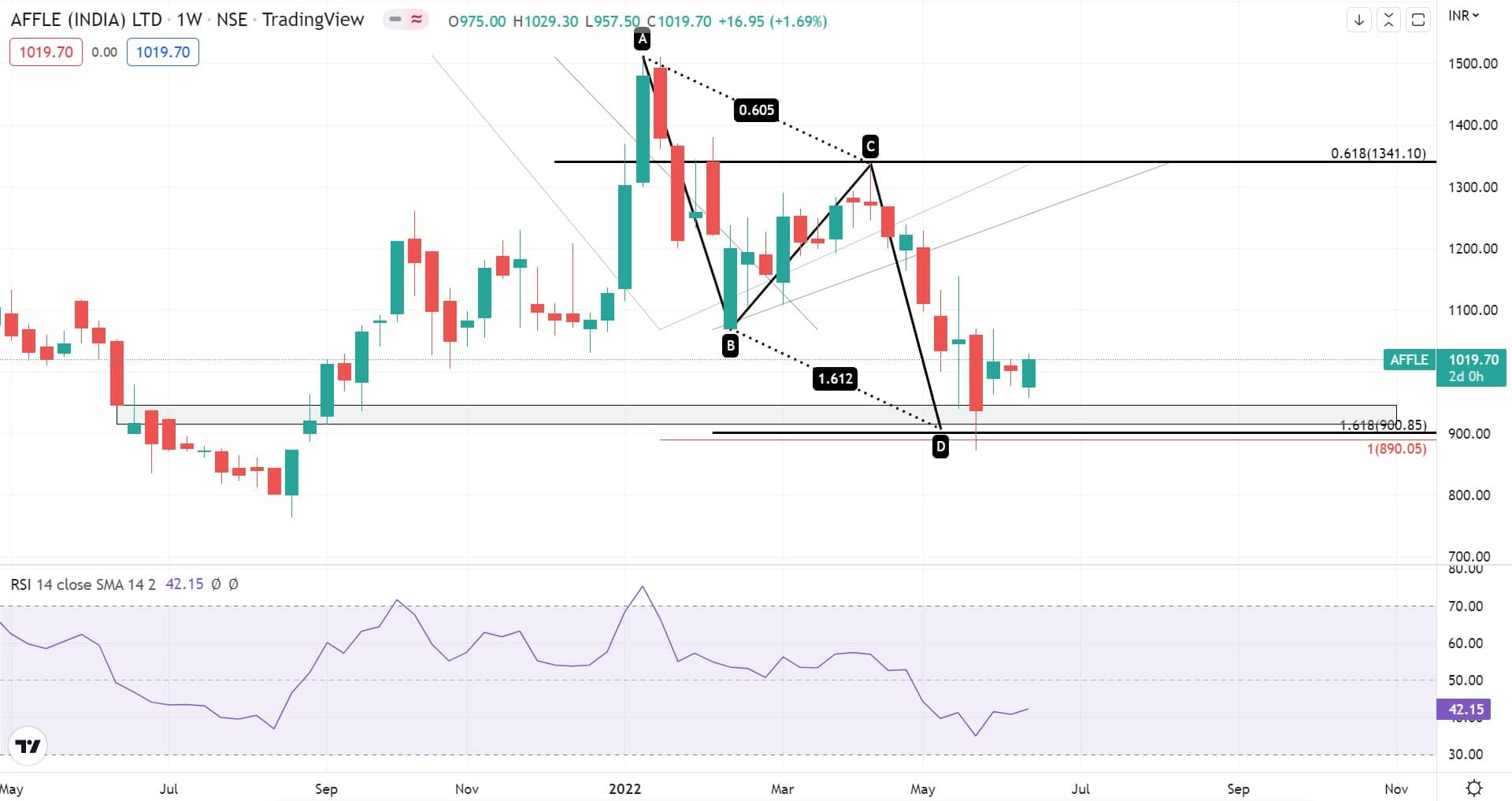

On the weekly chart, the counter has accomplished the N-wave formation close to its essential help zone of Rs 950 and rebounded properly.

Affle additionally fashioned a bullish AB=CD sample on the weekly chart together with the relative energy index (RSI) making an impulsive construction close to 30 ranges, which is trying profitable.

So, at present ranges, one should purchase in small tranches and purchase one other at Rs 990. An upside is seen until Rs 1,200, with good help at Rs 940-950.

Stride Pharma has corrected nearly 65 % within the final couple of years. At current, it has fashioned a bullish alternate BAT sample on the weekly chart together with weekly RSI making a bullish divergence close to its potential reversal of Rs 280-300, making it good for long-term funding.

One should buy this instantly since these are historic ranges. The upside is seen until Rs 500-550, with good help at Rs 260-270.

IGL has a traditional setup the place essential help of Rs 340 has been examined a number of instances. On three hours chart, it has fashioned Bullish BAT sample with a possible reversal zone of 340-350. RSI on three hours chart has displayed an impulsive construction, which hints at optimistic momentum.

One should buy the inventory at present ranges, with upside potential until Rs 385 with help seen at Rs 340.

Disclaimer: The views and funding suggestions expressed by specialists on Moneycontrol.com are their very own and never these of the web site or its administration. Moneycontrol.com advises customers to verify with licensed specialists earlier than taking any funding choices.

[ad_2]

Source link