[ad_1]

Jubilant Ingrevia Restricted (NSE:JUBLINGREA) is about to commerce ex-dividend within the subsequent three days. The ex-dividend date is one enterprise day earlier than an organization’s file date, which is the date on which the corporate determines which shareholders are entitled to obtain a dividend. The ex-dividend date is essential as a result of any transaction on a inventory must have been settled earlier than the file date in an effort to be eligible for a dividend. In different phrases, traders should purchase Jubilant Ingrevia’s shares earlier than the twenty third of August in an effort to be eligible for the dividend, which will probably be paid on the twenty fifth of October.

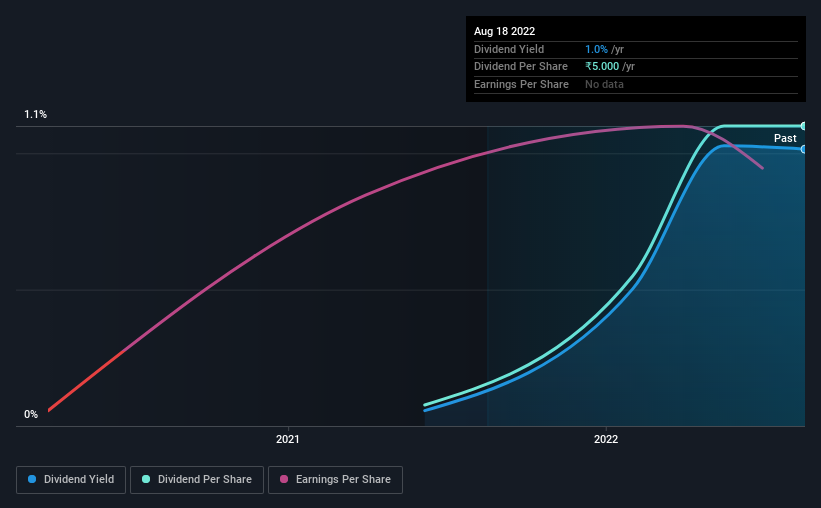

The corporate’s subsequent dividend fee will probably be ₹2.50 per share. Final 12 months, in whole, the corporate distributed ₹5.00 to shareholders. Primarily based on the final 12 months’s value of funds, Jubilant Ingrevia has a trailing yield of 1.0% on the present inventory value of ₹492.75. We love seeing corporations pay a dividend, nevertheless it’s additionally essential to ensure that laying the golden eggs is not going to kill our golden goose! We have to see whether or not the dividend is roofed by earnings and if it is rising.

See our latest analysis for Jubilant Ingrevia

If an organization pays out extra in dividends than it earned, then the dividend would possibly grow to be unsustainable – hardly a really perfect state of affairs. Jubilant Ingrevia has a low and conservative payout ratio of simply 21% of its earnings after tax. But money movement is often extra essential than revenue for assessing dividend sustainability, so we must always all the time examine if the corporate generated sufficient money to afford its dividend. Fortunately it paid out simply 20% of its free money movement final 12 months.

It is constructive to see that Jubilant Ingrevia’s dividend is roofed by each earnings and money movement, since that is usually an indication that the dividend is sustainable, and a decrease payout ratio often suggests a higher margin of security earlier than the dividend will get lower.

Click on here to see how much of its profit Jubilant Ingrevia paid out over the last 12 months.

Have Earnings And Dividends Been Rising?

Shares in corporations that generate sustainable earnings progress typically make one of the best dividend prospects, as it’s simpler to elevate the dividend when earnings are rising. If earnings fall far sufficient, the corporate may very well be compelled to chop its dividend. With that in thoughts, it is good to see earnings have grown 5.7% on final 12 months. Earnings per share have been rising at a good charge, and the corporate is retaining greater than three-quarters of its earnings within the enterprise. If earnings are reinvested successfully, this may very well be a bullish mixture for future earnings and dividends.

One 12 months is just not very lengthy within the grand scheme of issues although, so we would not draw too sturdy a conclusion based mostly on these outcomes.

Provided that Jubilant Ingrevia has solely been paying a dividend for a 12 months, there’s not a lot of a previous historical past to attract perception from.

The Backside Line

Ought to traders purchase Jubilant Ingrevia for the upcoming dividend? Earnings per share have been rising reasonably, and Jubilant Ingrevia is paying out lower than half its earnings and money movement as dividends, which is a beautiful mixture because it suggests the corporate is investing in progress. It may be good to see earnings rising sooner, however Jubilant Ingrevia is being conservative with its dividend payouts and will nonetheless carry out fairly over the long term. It is a promising mixture that ought to mark this firm worthy of nearer consideration.

Whereas it is tempting to put money into Jubilant Ingrevia for the dividends alone, you must all the time be conscious of the dangers concerned. When it comes to funding dangers, we’ve identified 1 warning sign with Jubilant Ingrevia and understanding them needs to be a part of your funding course of.

Typically, we would not suggest simply shopping for the primary dividend inventory you see. Here is a curated list of interesting stocks that are strong dividend payers.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Discounted money movement calculation for each inventory

Merely Wall St does an in depth discounted money movement calculation each 6 hours for each inventory in the marketplace, so if you wish to discover the intrinsic worth of any firm simply search here. It’s FREE.

[ad_2]

Source link