[ad_1]

da-kuk

Funding Thesis

India’s inventory market is crushing the S&P 500 by double digits, fueled by the fastest-growing economic system on earth, and the one method U.S.-based retail buyers can journey this wave is thru alternate traded funds. One choice, amongst many, is the WisdomTree India Earnings ETF (NYSEARCA:EPI), a sensible beta automobile with a comparatively low P/E ratio that may present entry to over 470 worthwhile Indian firms throughout eleven sectors and all market caps. Though I charge it a purchase, this suggestion comes with a collection of large-print warning labels, for it definitely isn’t the least costly nor even the highest-performing inside the India asset sub class.

On this article I goal to: (1) present primary info about why India presents an thrilling funding alternative, (2) analyze EPI’s holdings and deal with issues about top-heaviness, and (3) conduct a comparative evaluation of EPI’s efficiency, dangers, progress, and worth metrics (in opposition to a pair iShares ETFs I additionally give a purchase ranking to).

India’s Economic system and Markets

India’s economic system and fairness markets definitely look fairly engaging for buyers regardless the place they’re situated. India’s gross home product (GDP) rose by 13.5% within the April-June quarter, making its economic system the fastest-growing on earth. India is anticipated to complete second solely to Saudi Arabia in GDP progress charge in 2022 whereas the IMF initiatives the south Asian big to achieve the primary spot subsequent 12 months. It additionally simply surpassed the UK in complete GDP to grow to be the world’s fifth largest economy, in a powerful leap from the eleventh spot India occupied a decade in the past. As well as, in keeping with IMF information, by 2025 India’s GDP is anticipated to rise 50 %: from $3.53 trillion to $5.3 trillion.

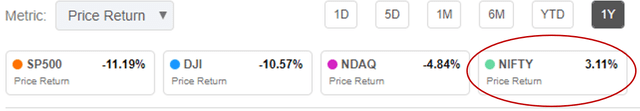

This explosive progress has circuitously translated into excessive inventory costs, however each of India’s main indices, SENSEX and the Nifty 50, have outperformed the S&P 500 by almost 15% over the previous twelve months.

India’s NIFTY 50 rocks US indices in previous 12 months (In search of Alpha Premium)

Nevertheless, it is very important point out that India’s economic system and markets face key dangers comparable to continuous tightening of financial coverage because the nation’s central financial institution tries to rein in inflation, together with low levels of private sector investment. Energy shortages and hovering power prices have compelled the federal government to intervene to manage petroleum exports to satisfy rising home demand, which induced the trade deficit to rise to record levels in July.

With that stated, even when contemplating the dangers, the Indian economic system continues to be price betting on. (And, to be sincere, India has been a far safer wager than almost all of my U.S.-based investments).

EPI Profile & Holdings

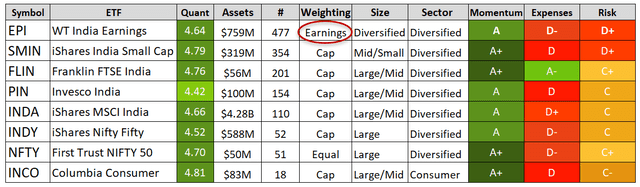

All eight India ETFs that acquired In search of Alpha quant scores all rated as sturdy buys total, primarily as a result of excessive momentum grades. Every ETF has strengths and weaknesses however the principle distinction will come right down to the investor’s funding goal by way of elements comparable to weighting technique, danger degree, quantity and consolidation of holdings, together with market cap combine, amongst others.

India ETFs Profile Overview (Information sources: In search of Alpha Premium/Fund web sites)

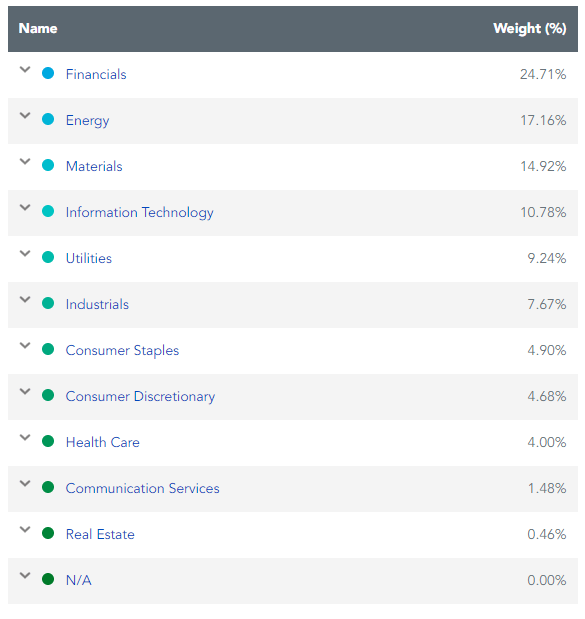

The EPI fund, incepted in 2008, consists of round 477 shares price almost $760 million that are all traded on both or each of India’s two predominant exchanges: the Mumbai (Bombay) Inventory Alternate (BSE) and the Nationwide Inventory Alternate (NSE). The EPI takes a consultant pattern from its underlying asset – the WisdomTree India Earnings Index. The index, reconstituted yearly, solely consists of shares from firms which have recorded at the least $5 million in revenue within the previous fiscal 12 months, a P/E of at the least 2 and market cap of at the least $200 million. The fund is diversified throughout eleven trade sectors, though financials, power, primary materials, and expertise make up 67% of the fund’s Web Asset Worth (NAV).

EPI Holdings by Sector (WisdomTree)

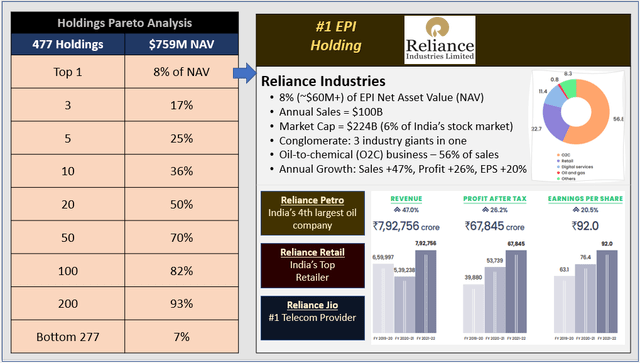

By way of holdings breakdown, the fund is comparatively top-heavy, as this pareto evaluation reveals, with the highest three of the 477 shares accounting for 17% of the fund’s complete worth. Furthermore, one single inventory, Reliance Industries Restricted (RIL), represents 8 % of the whole worth. Nevertheless, this isn’t essentially a nasty factor.

EPI Holdings Pareto & High Inventory (Information Sources: WisdomTree, Reliance Industries FY22 Annual Report)

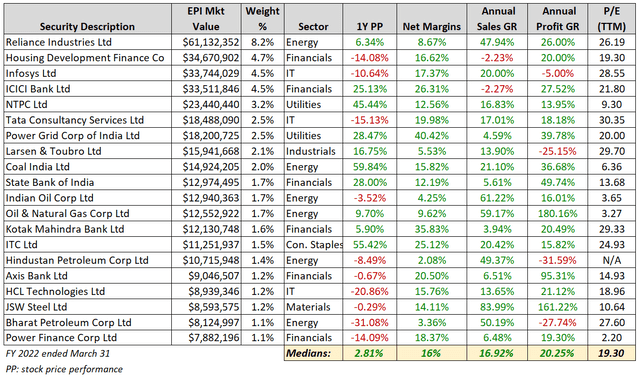

The under desk reveals the highest 20 holdings, which account for 50% of the EPI fund’s complete asset worth, together with every inventory’s 1-year value efficiency, as of 9/12/22, along with progress, revenue, and P/E figures. The annual numbers are based mostly on fiscal 12 months 2022, which ended on March 31 for many Indian firms.

High 20 EPI Holdings (Information Sources: WisdomTree, The Financial Occasions (India))

The median P/E of almost 20 is attention-grabbing as a result of, as we will see, EPI claims the fund has an total P/E of round 12 and is a key aggressive differentiator versus different funds.

It’s price taking a look at RIL in additional element, given it makes up 8% of the portfolio, and observing some exceptional info that might partly alleviate issues concerning the fund’s top-heaviness. For starters, RIL isn’t merely an power firm wholly vulnerable to grease market perturbations, because the slide above illustrates. It’s actually three multibillion-dollar firms wrapped up in a single, that dominate three sectors: power, shopper discretionary, and communication providers. RIL, to make certain, derives a majority of its $100 billion in annual income from its oil-to-chemical (O2C) phase. However greater than 20% of gross sales comes from Reliance Retail, ranked because the second quickest rising retailer on this planet in a Deloitte trade outlook launched in February. Lastly, there may be the digital enterprise which incorporates India’s largest cellular community operator Jio.

Comparative Evaluation: EPI vs. INDA/SMIN

Though eight ETFs below the identical India fairness sub class as EPI have garnered sturdy In search of Alpha quant scores, for comparability functions I selected two iShares ETFs that mixed characterize the same alternative by way of dimension and sort of publicity, though with out the sensible beta technique. The truth is, Blackrock truly recommends shopping for iShares MSCI India Small Cap Index ETF (SMIN) and the MSCI India ETF (INDA) given there isn’t any overlap.

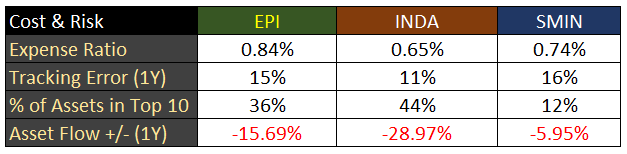

EPI, INDA, and SMIN have high In search of Alpha marks in momentum relative to all different ETFs, however their expense ratios are painfully outlandish in comparison with the median of 0.45%, which is a value that will have to be paid. EPI and SMIN have low danger scores partly as a result of poor monitoring errors: that’s, the distinction between the precise returns of the fund in comparison with the underlying benchmark. The excessive expense ratios and monitoring errors seemingly clarify why these ETFs usually are not performing in addition to India’s predominant indexes like Nifty 50 and Sensex.

The asset flows have been down for all 3 funds previously 12 months, though within the final 30 days there was a turnaround with EPI up 12%, INDA +4, and SMIN +7%. EPI additionally will get an F briefly curiosity as % of shares excellent in comparison with the median (10% vs. 0.52%).

EPI Peer Comparability: Price and Threat (Information Supply: In search of Alpha Premium)

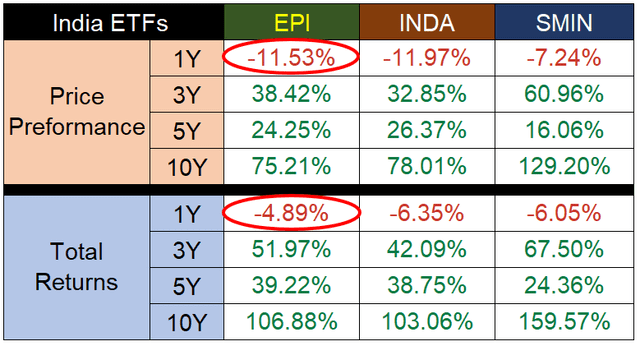

When it got here to buying and selling value efficiency over the previous 12 months, each iShares ETFs beat EPI. Nevertheless, EPI got here out forward by way of complete return, which was considerably shocking.

EPI Peer Comparability: Worth and Whole Returns (as of 9/12/22) (Information Supply: In search of Alpha Premium)

After evaluating distributions it seems that EPI benefited significantly by a quarterly dividend of $1.84 paid out on the finish of June, which represents a leap of 826% in dividend progress charge, which boosted the yield to six.82%. That is fairly an outlier when contemplating EPI’s common payout previously 4 quarters is $0.12 and its highest quarterly payout since inception was $0.19 on the finish of 2021.

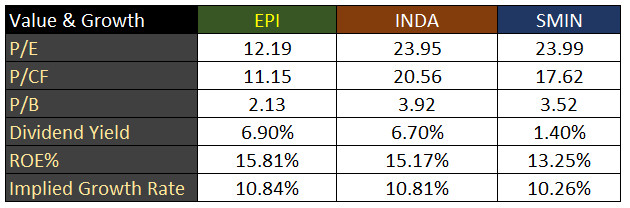

By way of progress and worth metrics, EPI has a really encouraging P/E ratio for worth buyers in comparison with its friends with a strong dividend yield. The implied progress, calculated by WisdomTree as retained earnings multiplied by ROE, isn’t stellar, however strong in opposition to a aggressive discipline.

EPI Peer Comparability – Worth and Progress Metrics (WisdomTree)

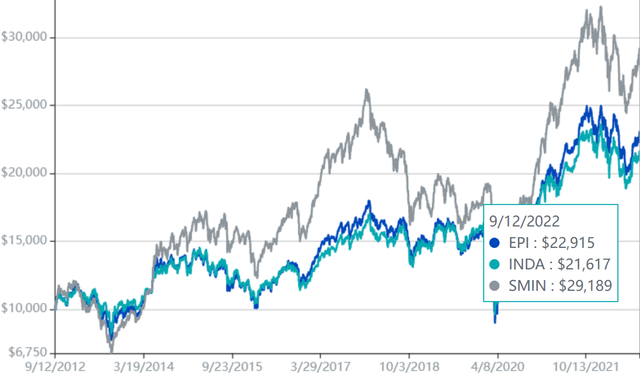

$10,000 sunk into every fund a decade in the past would return the next based mostly on WisdomTree’s NAV comparison tool, which reveals SMIN outperforming with a 190% return on funding.

$10,000 funding progress over 10 years (WisdomTree)

Conclusion

Proper now’s the very best time to put money into Indian firms and shopping for shares of the EPI ETF is an effective way to do it. Though not the most cost effective or highest performing of the India ETFs, EPI has nice upside with a portfolio that affords broad publicity to worthwhile firms in eleven sectors throughout all market caps, a low P/E ratio, and an amazing dividend yield. Nevertheless, though it deserves a purchase ranking, together with INDA and SMIN, buyers ought to preserve a detailed eye on dividend consistency and monitoring errors and monitor if EPI is bettering by way of getting nearer to matching the precise returns of India’s booming markets.

[ad_2]

Source link