[ad_1]

A month-to-month expiry of futures & choices (F&O) derivatives and knowledge on auto gross sales will possible affect actions on Dalal Avenue this week. Apart from, international cues will stay on traders’ radar, with a key GDP studying from the world’s largest economic system, at a time when aggressive hikes in COVID-era rates of interest proceed to stoke fears over an financial slowdown.

Volatility could persist available in the market forward of the month-to-month F&O expiry due within the second half of the week, in keeping with Yesha Shah, Head of Fairness Analysis at Samco Securities.

The week that was

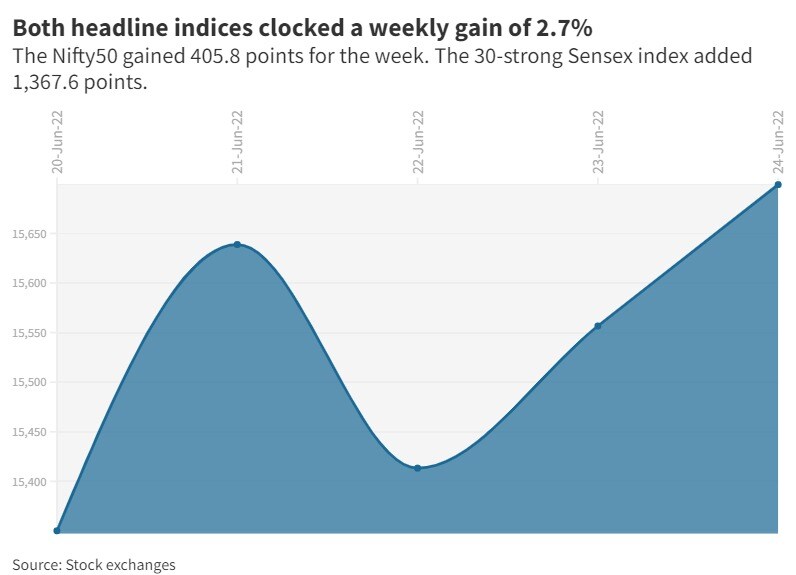

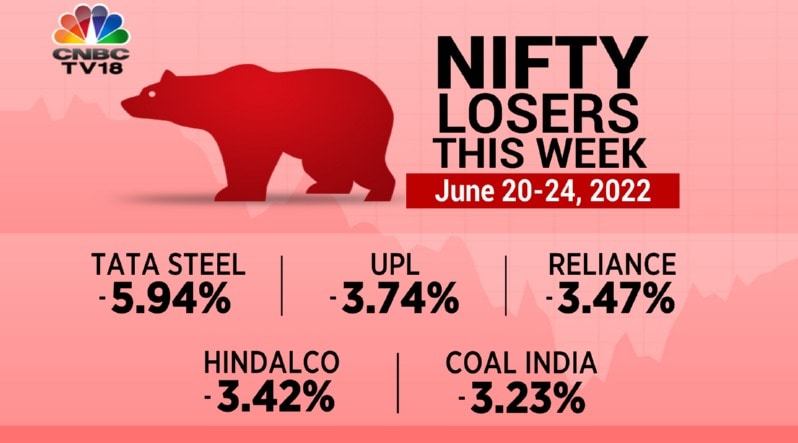

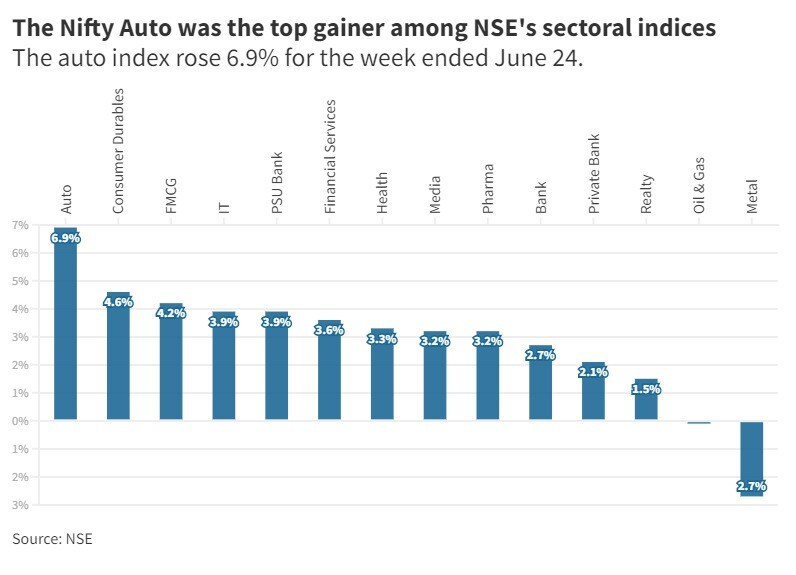

Indian fairness benchmarks logged weekly good points of just about three % within the week ended June 24 — following two back-to-back weeks of losses — led by pockets comparable to auto, IT and client shares.

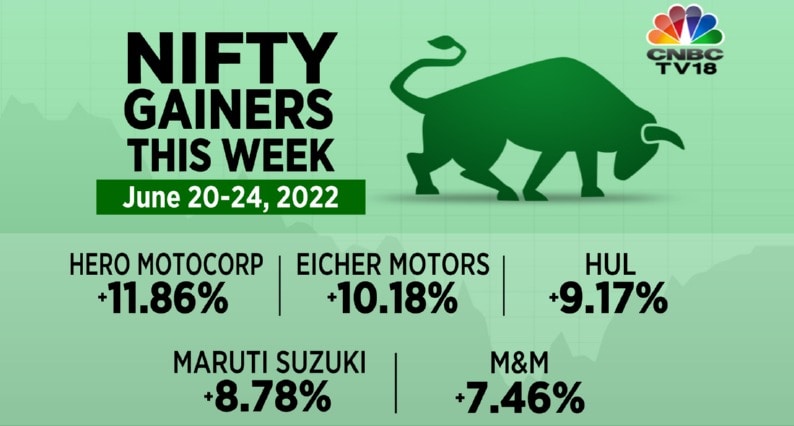

A complete of 28 shares within the Nifty50 basket noticed weekly good points.

Asian Paints, HDFC, TCS, Divi’s and Titan — rising between 5.6 % and 7 % — have been additionally among the many prime gainers.

It was the perfect week for the Nifty Auto index since February 2021, boosted by Hero MotoCorp and Maruti Suzuki, which climbed up nearly 12 % and 9 % respectively.

Broader markets additionally bled, reflecting the weak spot in headline indices.

| Index | Weekly change (%) |

| Nifty Midcap 100 | 2.2 |

| Nifty Smallcap 100 | 1.7 |

The highway forward

“The pullback within the Indian market final week appears extra like a reduction rally than a full-fledged restoration. World macros proceed to stay difficult and should proceed to behave as a drag on Indian shares,” stated Rahul Shah, Co-Head of Analysis at Equitymaster.

Technical view

Samco’s Shah suggests merchants to retain a neutral-to-slightly-bullish bias so long as the Nifty50 stays above quick assist at 15,200. “Instant resistance is about at 15,900,” she stated.

Listed below are the important thing components and occasions which might be prone to affect Dalal Avenue within the week starting June 27:

DOMESTIC CUES

The F&O expiry is due on June 30. Official knowledge on eight core sectors — also referred to as infrastructure knowledge — may even be launched on the identical day.

Auto producers will begin to report their gross sales numbers for June on Friday.

GLOBAL CUES

| Date | US | Europe | Asia |

| June 27 | Dwelling gross sales | France unemployment knowledge | |

| June 28 | ECB President Christine Lagarde resulting from communicate | ||

| June 29 | GDP knowledge, Fed Chair Jerome Powell and officialLoretta Mester to talk, crude oil stockpiles | Germany inflation knowledge | |

| June 30 | Jobless date | UK GDP knowledge, Germany retail gross sales, France inflation knowledge, ECB President to talk | Japan retail gross sales and client confidence knowledge |

| July 1 | Manufacturing PMI knowledge | Eurozone inflation knowledge | Japan unemployment knowledge and inflation knowledge |

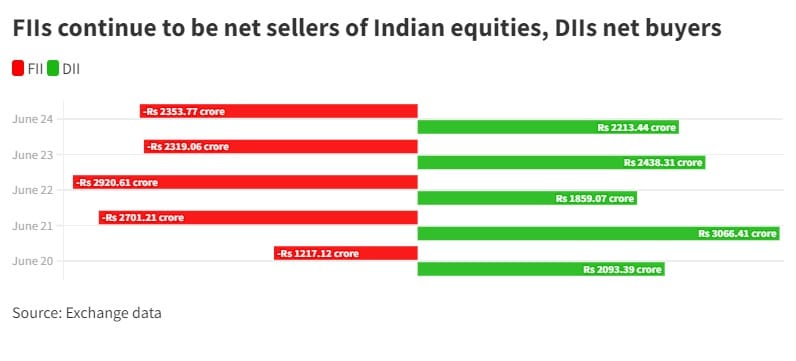

FII exercise

Institutional fund flows will proceed to be on traders’ radar, with Dalal Avenue on observe to complete a ninth straight fund of fairness promoting by overseas institutional traders.

FIIs web offered Indian shares value Rs 11,511.8 crore final week, in keeping with provisional change knowledge. Home institutional traders, nonetheless, made web purchases of Rs 11,670.6 crore.

Company motion

| Firm | Ex date | Goal | File date |

| Salasar Techno Engineering | June 27 | Inventory break up from Rs 10 to Re 1 | June 28 |

| Tranway Tech | June 27 | EGM | – |

| Kachchh Minerals | June 28 | EGM | – |

| SKF India | June 28 | Dividend Rs 14.5 | June 29 |

| Whirlpool | June 28 | Remaining dividend Rs 5 | – |

| Sona BLW Precision Forgings | June 29 | Remaining dividend Re 0.77 | June 30 |

| Tata Metal Lengthy Merchandise | June 29 | Dividend Rs 12.5 | – |

| Vaibhav World | June 29 | Remaining dividend Re 1.5 | – |

| A-1 Acid | June 30 | Remaining dividend Re 1.5 | – |

| Bajaj Auto | June 30 | Dividend Rs 140 | July 1 |

| Bajaj Finserv | June 30 | Dividend Rs 4 | July 1 |

| Bajaj Holdings & Funding | June 30 | Remaining dividend Rs 25 | July 1 |

| Bajaj Finance | June 30 | Dividend Rs 20 | July 1 |

| Biocon | June 30 | Remaining dividend Re 0.5 | July 1 |

| EKI Power Providers | June 30 | Bonus challenge 3:1 | July 1 |

| Escorts | June 30 | Dividend Rs 7 | – |

| Gandhi Particular Tubes | June 30 | Remaining dividend Rs 10 | July 1 |

| Indian Oil | June 30 | Bonus challenge 1:2 | July 1 |

| Larsen & Toubro Infotech | June 30 | Dividend Rs 30 | July 1 |

| Maharashtra Scooters | June 30 | Remaining dividend Rs 80 | July 1 |

| Nippon Life India Asset Administration | June 30 | Remaining dividend Rs 7.5 | July 1 |

| Nucleus Software program Exports | June 30 | Remaining dividend Rs 7 | – |

| Paisalo Digital | June 30 | Inventory break up from Rs 10 to Re 1 | July 1 |

| PTL Enterprises | June 30 | Dividend Rs 2 | July 1 |

| Quest Capital Markets | June 30 | Remaining dividend Rs 2.5 | – |

| Ratnamani Metals & Tubes | June 30 | Bonus challenge 1:2 | July 1 |

| Raymond | June 30 | Remaining dividend Rs 3 | – |

| Suryaamba Spinning Mills | June 30 | Remaining dividend Re 1 | – |

| Swaraj Engines | June 30 | Dividend Rs 80 | – |

| Syngene Worldwide | June 30 | Remaining dividend Re 0.5 | July 1 |

| Syngene Worldwide | June 30 | Particular dividend Re 0.5 | July 1 |

| Welspun Enterprises | June 30 | Remaining dividend Re 1.5 | – |

| Anant Raj | July 1 | Remaining dividend Re 0.12 | – |

| Geojit Monetary Providers | July 1 | Remaining dividend Rs 3 | July 4 |

| Jyothy Labs | July 1 | Remaining dividend Rs 2.5 | – |

| L&T Finance Holdings | July 1 | Remaining dividend Re 0.5 | July 4 |

| Matrimony.com | July 1 | Share buyback | July 4 |

| Motilal Oswal Monetary Providers | July 1 | Dividend Rs 3 | July 4 |

| Siyaram Silk Mills | July 1 | Remaining dividend Rs 3.2 | – |

| Swasti Vinayaka Artwork and Heritage Company | July 1 | Bonus challenge 5:4 | July 4 |

| Tide Water Oil | July 1 | Remaining dividend Rs 15 | – |

| XPRO India | July 1 | Bonus challenge 1:2 | July 4 |

[ad_2]

Source link