Daily Day Trading Tips for Sure Profits from Indian Stock Market

Daily Day Trading Tips for Sure Profits from Indian Stock Market

There are people who believe day trading is an easy way to make great profit, but in reality it’s not so easy. Those who day trade for excitement only end up lost.It is true that advances in technology and the internet offer better opportunities for day traders. The dissemination of information has leveled the field to a major extent, and now traders no longer need to sit by the phone waiting for calls from their brokers. Day traders have a fresh start each new day, they sleep like babies not worrying about a fall or rise in their stock value.

Although day trading is much more demanding than position trading, making sure profits through day trading is possible if traders are totally focused and have good tips to assist them make the right decision.

- Treat day trading as a business.

If you look at your day trading as a part time thing, making sure profits won’t be possible. It is not a part-time diversion. It is very demanding, so you would need to be totally focused and eliminate distractions. Confine yourself and concentrate fully on the trade at hand with all seriousness.

- Be a day trader

It is important to know that the right kinds of market conditions are not present every day and it would be too intense to trade day-in day-out. You do not need to take every signal or trade every market, you have the luxury to wait and observe the market’s reaction before taking action.

- Be disciplined.

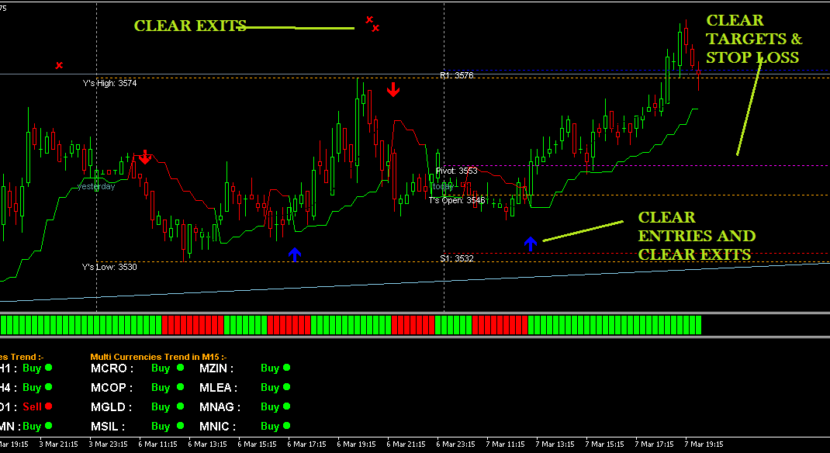

Discipline can never be ruled out when it comes to day trading successfully, especially when you desire to make sure profits. You need to follow every well written and defined rules systematically; this will help you take your emotion out of the equation. A good way to go about disciplining yourself is to construct a game plan which you will follow without bias. If you disregard your game plan, you might end up losing some of the best and most profitable trades. Your plan should have well defined entry and exit rules from a tested program or system that you have confidence in. Always use stops, and never cancel it for anything.

- Go only where the action is

It is good to be aware of the current trading environment as day trading requires volatility and liquidity. Not all market are volatile enough for consistent profits, so you need a market that not only moves but moves within a limited time frame. You can look for markets to invest in the news.

- Be cautious after a big hit.

After making a big win, there might be temptations to over trade. Do not overtrade. Look for single trades instead of going into 2 0r 3 at a time. This is to keep yourself in check.

- Make sure you’re feeling good.

Day trading is quite demanding,it’sall about moving faster and smarter than the competition and if you’re not physically or emotionally fine you can’t trade effectively.

Above all, patience is an important virtue when it comes to day trading. Not every strategy works every day, you might have to wait a while to find a good trade. You will also make mistakes and it will take time to get comfortable with your trading decisions. It is advised to trade on paper first before going live, but if you absolutely want to trade live right away, please do so with a small amount of shares.

Get Access To Free Mt4 Indicators & Much More

Phone

+91-9958406102

Skype

intraday.trading

StockRadar.in

Telegram

Stockxperts

Working Steps We Follow

1

Research

2

DEVELOP

3

TEST PHASE

4

LAUNCH

Inquiries

For any inquiries please email

[contact-form-7 404 “Not Found”]

+91-9958406102

- . Experienced .

- Specialized .

- Professional .

testimonials

What Client’s Saying

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Nelson Edward

Insurance Group

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Thomas Saleh

Insurance Group

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Nelson Edward

Insurance Group

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Nelson Edward

Insurance Group

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Thomas Saleh

Insurance Group

Fugiat nulla pariatur excepteur sint sed cupidatat non proident, sunt in culp quip deserunt mollit animy est laborum sed perspiciatis unde omnis iste.

Nelson Edward

Insurance Group